5 Simple Techniques For Pvm Accounting

5 Simple Techniques For Pvm Accounting

Blog Article

Examine This Report on Pvm Accounting

Table of ContentsWhat Does Pvm Accounting Mean?Getting My Pvm Accounting To WorkPvm Accounting - Truths5 Simple Techniques For Pvm AccountingPvm Accounting Fundamentals ExplainedHow Pvm Accounting can Save You Time, Stress, and Money.How Pvm Accounting can Save You Time, Stress, and Money.

In regards to a company's total strategy, the CFO is responsible for guiding the business to satisfy monetary objectives. Several of these techniques can entail the business being gotten or acquisitions going onward. $133,448 each year or $64.16 per hour. $20m+ in annual profits Specialists have evolving needs for workplace managers, controllers, bookkeepers and CFOs.

As a service expands, bookkeepers can free up extra team for various other organization obligations. This could at some point lead to improved oversight, higher precision, and far better compliance. With even more sources adhering to the path of cash, a contractor is much a lot more most likely to get paid accurately and on schedule. As a building and construction business grows, it will demand the help of a permanent monetary staff that's managed by a controller or a CFO to deal with the company's finances.

All about Pvm Accounting

While big businesses might have full-time economic assistance teams, small-to-mid-sized companies can work with part-time bookkeepers, accountants, or economic consultants as required. Was this article useful?

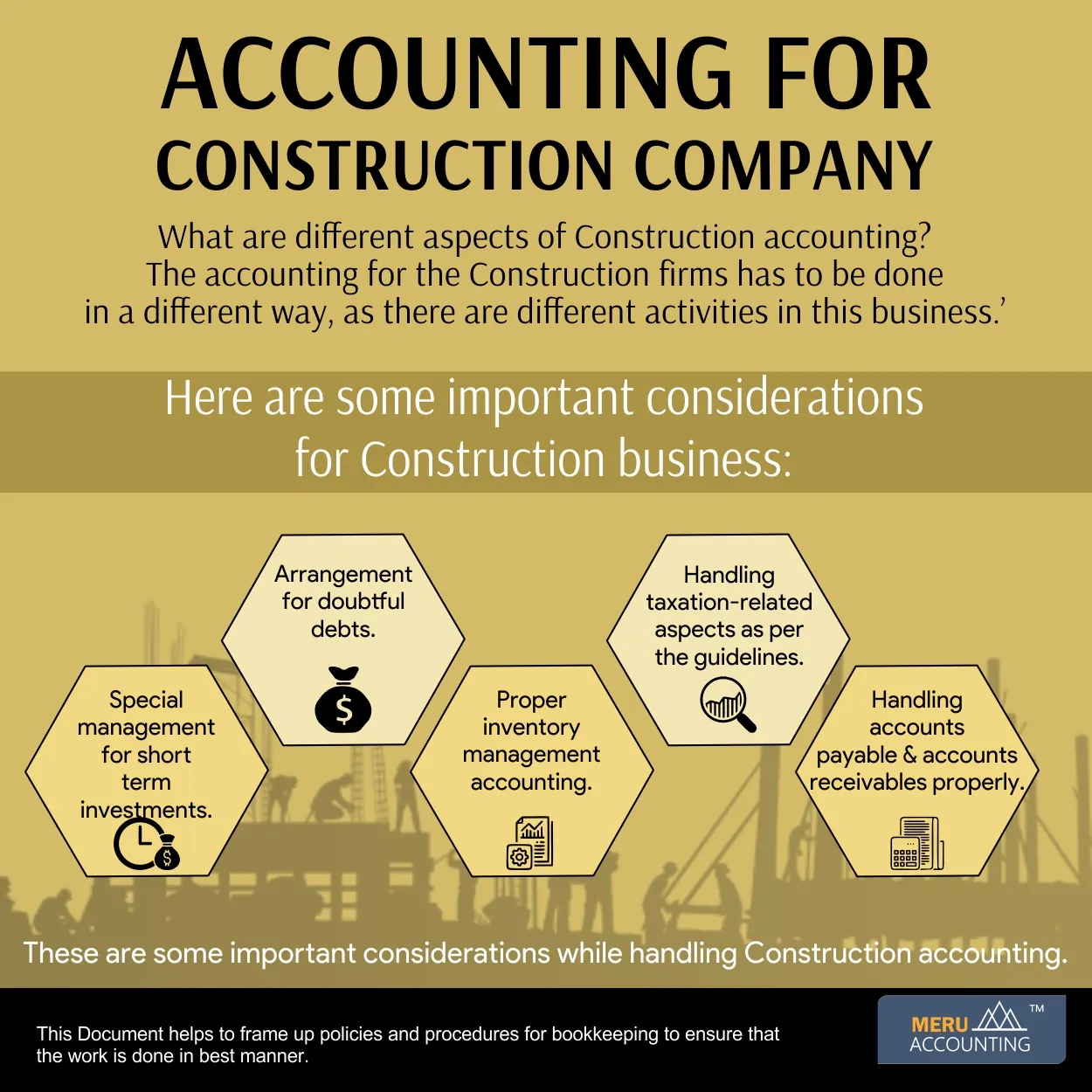

As the construction sector remains to grow, businesses in this market have to maintain strong financial administration. Efficient audit practices can make a substantial distinction in the success and development of building companies. Allow's discover five necessary accountancy methods customized particularly for the construction industry. By applying these practices, construction companies can boost their monetary security, improve operations, and make notified decisions - construction bookkeeping.

Comprehensive estimates and budget plans are the backbone of building project management. They aid steer the project towards prompt and lucrative conclusion while securing the interests of all stakeholders entailed. The vital inputs for task cost evaluation and budget are labor, products, tools, and overhead expenditures. This is normally one of the greatest expenses in construction tasks.

See This Report about Pvm Accounting

An exact estimation of products needed for a task will aid guarantee the necessary products are bought in a prompt manner and in the ideal amount. A misstep right here can lead to wastefulness or delays as a result of material lack. For many construction jobs, tools is needed, whether it is acquired or leased.

Appropriate tools evaluation will certainly assist make certain the ideal devices is readily available at the correct time, conserving time and money. Do not fail to remember to represent overhead costs when approximating job prices. Straight overhead expenses are specific to a job and may include temporary services, utilities, secure fencing, and water supplies. Indirect overhead costs are daily costs of running your business, such as rent, management wages, utilities, taxes, devaluation, and advertising and marketing.

Another aspect that plays into whether a project achieves success is an exact estimate of when the job will certainly be finished and the associated timeline. This price quote aids make certain that a job can be finished within the designated time and resources. Without it, a job may lack funds before completion, creating possible job blockages or desertion.

Pvm Accounting Things To Know Before You Get This

Accurate task costing can assist you do the following: Understand the earnings (or do not have thereof) of each job. As work setting you back breaks down each input right into a task, you can track profitability individually. Compare actual prices to quotes. Managing and examining estimates allows you to far better cost jobs in the future.

By identifying these products while the job is being finished, you avoid shocks at the end of the project and can deal with (and ideally stay clear of) them in future projects. A WIP schedule can be completed monthly, quarterly, semi-annually, or every year, and consists of task data such as agreement worth, sets you back sustained to date, complete approximated prices, and complete job payments.

The Definitive Guide for Pvm Accounting

It also provides a clear audit trail, which is vital for financial audits. Clean-up accounting and compliance checks. Budgeting and Projecting Tools Advanced software program offers budgeting and forecasting capacities, allowing construction firms to plan future projects a lot more accurately and manage their finances proactively. Document Monitoring Building tasks include a great deal of paperwork.

Enhanced Supplier and Subcontractor Management The software application can track and manage settlements to suppliers and subcontractors, ensuring timely repayments and keeping excellent connections. Tax Obligation Preparation and Filing Audit software program can assist in tax preparation and filing, ensuring that all relevant monetary tasks are accurately reported and tax obligations are submitted on schedule.

Pvm Accounting Fundamentals Explained

Our customer is a growing growth and building company with head office in Denver, Colorado. With several active building and construction jobs in Colorado, we are looking for an Accounting Aide to join our group. We are seeking a full time Bookkeeping Assistant who will certainly be in charge of giving functional support to the Controller.

Obtain and assess daily invoices, subcontracts, change orders, acquisition orders, inspect demands, and/or other related documents for completeness and conformity with financial plans, treatments, budget, and contractual demands. Accurate processing of accounts payable. Go into invoices, accepted attracts, order, etc. Update monthly analysis and prepares budget pattern reports for construction jobs.

The Buzz on Pvm Accounting

In this guide, we'll explore different elements of construction bookkeeping, its relevance, the standard tools used in this field, and its role in building jobs - https://pvmaccount1ng.blog.ss-blog.jp/2024-05-22?1716376193. From financial control and expense estimating to capital management, discover just how accounting can profit building and construction jobs of all scales. Building bookkeeping refers to the customized system and procedures made use of to track economic details and make strategic choices for building and construction services

Report this page